Read Time: 7 minutes

Buying your first home should be exciting, not terrifying. But here's the thing – most first-time buyers walk into this process completely unprepared and end up making costly mistakes that could have been easily avoided.

You've probably heard horror stories from friends or family about their homebuying nightmares. The truth is, these disasters usually stem from the same handful of mistakes that first-time buyers make over and over again.

The good news? Once you know what these pitfalls are, they're actually pretty easy to sidestep. Let's dive into the most common mistakes that trip up new buyers and how you can avoid them.

The Pre-Approval Problem: Your Biggest Financial Mistake

Here's mistake number one, and it's a doozy: skipping mortgage pre-approval.

You might think you can just look at homes and figure out the money stuff later. Big mistake. Without pre-approval, you're basically window shopping with no idea what you can actually afford. Even worse, in today's competitive market, sellers won't even consider offers from buyers who aren't pre-approved.

Think about it from a seller's perspective – would you accept an offer from someone who might not even qualify for a mortgage?

Pro Tip: Get pre-approved before you even start looking at homes online. It takes about a week and gives you a clear budget to work with.

But here's where most people mess up next: they get pre-approved with the first lender they call. Not shopping around for mortgage rates is like buying the first car you see on the lot. Different lenders offer different rates and terms, and even a small difference in interest rates can save you thousands over the life of your loan.

The Hidden Costs That Blindside First-Time Buyers

Let's talk about money – specifically, all the money you didn't know you'd need to spend.

Most first-time buyers focus on two numbers: the down payment and the monthly mortgage payment. But homeownership comes with a whole bunch of other costs that can seriously strain your budget if you're not prepared.

Here's what catches people off guard:

• Property taxes (which can be substantial depending on your area)

• Homeowners insurance (required by your lender)

• PMI (Private Mortgage Insurance) if you put down less than 20%

• HOA fees if you're buying in a community with an association

• Maintenance and repairs (plan for 1-3% of your home's value annually)

• Utilities (which can be much higher than apartment living)

• Closing costs (typically 2-5% of your home's purchase price)

A good rule of thumb? Your total monthly housing payment (including taxes and insurance) shouldn't exceed 28% of your gross monthly income.

Reality Check: The average first-time buyer in 2024 put down just 9% – not the traditional 20% you've probably heard about. Don't let the down payment myth keep you from exploring your options.

The Inspection Trap: Why "Saving Money" Costs You More

Here's a mistake that can cost you tens of thousands of dollars: waiving the home inspection to save a few hundred bucks or make your offer more competitive.

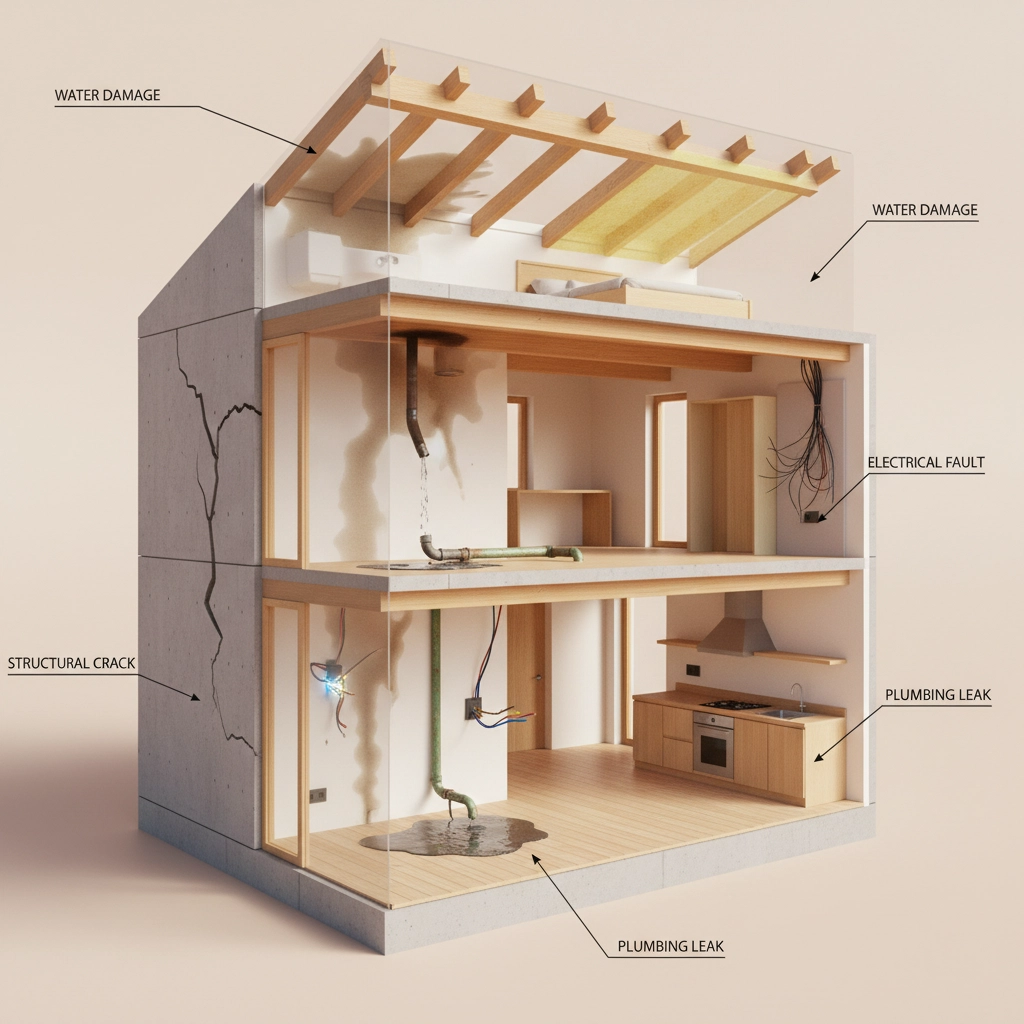

I get it. Home inspections cost money (usually $300-500), and in a bidding war, you might think skipping it gives you an edge. But here's what a professional inspector looks for that you probably won't notice during your walkthrough:

• Foundation problems

• Roof damage or wear

• Electrical issues that could be fire hazards

• Plumbing problems that could lead to water damage

• HVAC system problems

• Structural issues

• Mold or pest infestations

Even if the seller provides their own inspection report, get your own. Their inspector works for them, not you. Your inspector works for you and will give you an unbiased assessment of the property's condition.

Pro Tip: If you're in a super competitive market, consider getting a pre-inspection on homes you're seriously interested in. It shows sellers you're serious and can help you make a stronger, more informed offer.

Location, Location, Location: The Neighborhood Mistake

You've found the perfect house – gorgeous kitchen, spacious bedrooms, beautiful hardwood floors. But did you research the neighborhood as thoroughly as you researched the house?

Falling in love with a house while ignoring the neighborhood is one of the most common mistakes first-time buyers make. Remember: you can renovate a kitchen, but you can't renovate a neighborhood.

Here's what you need to research about any area you're considering:

• School quality (even if you don't have kids – it affects resale value)

• Crime rates and overall safety

• Commute times to your workplace at different times of day

• Local amenities like grocery stores, restaurants, parks

• Future development plans that might affect your property value

• Noise levels at different times and days of the week

Don't just rely on online research. Visit the neighborhood multiple times – during rush hour, on weekends, in the evening. Walk around and get a feel for the community.

The Timing Trap: Too Fast or Too Slow

Timing is everything in real estate, and first-time buyers often get it wrong in one of two ways.

Mistake #1: Rushing the process. You find a house you like and immediately put in an offer without doing your homework. This leads to buyer's remorse and potentially costly oversights.

Mistake #2: Waiting for the "perfect" house. You keep looking and looking, waiting for that dream home that checks every single box. Meanwhile, good houses in your price range keep selling to other buyers.

The sweet spot? Take time to do your research and due diligence, but don't let perfect be the enemy of good. If a house meets 80% of your needs and is in your budget, it might be worth considering.

When Emotions Override Logic

Buying a home is emotional – it's probably the biggest purchase you'll ever make, and it's going to be your sanctuary. But letting emotions drive your decision-making can lead to expensive mistakes.

Here's how emotions can trip you up:

• You fall in love with a house that's over your budget

• You ignore red flags because you can "see the potential"

• You get caught up in bidding wars and overpay

• You make offers on the first house you see because you're excited

• You dismiss good houses because they don't match your Pinterest board

Stay objective by creating a must-have list before you start looking. What do you absolutely need versus what would be nice to have? Stick to your budget and your list, even when you find that charming fixer-upper with "so much character."

The Final Sprint: Pre-Closing Mistakes

You're in the home stretch – you've found your house, made an offer, and it's been accepted. Don't mess it up now with these common pre-closing mistakes:

Making large purchases before closing. Your lender will check your credit and financial situation right before closing. Buying a new car, furniture, or putting a vacation on credit cards can change your debt-to-income ratio and potentially torpedo your loan approval.

Not doing a final walkthrough. Always do a final walkthrough 24-48 hours before closing. Make sure any agreed-upon repairs were completed and that the house is in the same condition as when you made your offer.

The Money You're Leaving on the Table

Here's something most first-time buyers don't know: there are tons of programs designed specifically to help people like you buy homes. Not researching first-time homebuyer assistance programs could cost you thousands in unnecessary expenses.

Many programs offer:

• Down payment assistance

• Reduced interest rates

• Help with closing costs

• Tax credits

Check with your state housing authority, local housing departments, and even your employer – many companies offer homebuyer assistance as an employee benefit.

Your Action Plan to Avoid These Mistakes

Ready to buy your first home the smart way? Here's your step-by-step action plan:

- Get pre-approved with multiple lenders and compare rates

- Calculate your true budget including all homeownership costs

- Research neighborhoods as thoroughly as you research houses

- Never skip the home inspection – it's worth every penny

- Stay objective and stick to your must-have list and budget

- Research assistance programs in your area

- Avoid major purchases during the buying process

- Work with a trusted real estate agent who understands first-time buyers

The truth is, buying your first home doesn't have to be stressful or overwhelming. When you know what mistakes to avoid and have a solid plan to follow, the process becomes much more manageable.

Remember, every successful homeowner was once a first-time buyer who felt exactly like you do right now. The difference between those who have a great experience and those who have horror stories? Preparation and knowledge.

You've got this. And now you know exactly what pitfalls to sidestep along the way.

Ready to start your homebuying journey? Check out our comprehensive first-time buyer guides for even more detailed information about each step of the process.