Read Time: 7 minutes

If you've been scrolling through rental listings lately, you might be feeling pretty good about what you're seeing. Rent prices are finally starting to chill out after years of brutal increases, and some experts are even predicting actual rent decreases in 2026. Sounds like renting is the smart move, right?

Hold up. Before you get too comfortable with that apartment lease renewal, let's dig deeper into what's really happening in the housing market. Because here's the thing – softening rent prices might actually be setting you up to make a decision you'll regret later.

What's Really Happening with Rents in 2026

Let's start with the good news for renters. The rental market is definitely cooling off compared to the wild ride of the past few years. Different experts are predicting various scenarios, but they're all pointing in the same direction: rent growth is slowing way down.

Realtor.com is actually predicting that rents will decline by 1% nationally in 2026. Zillow is a bit more conservative, forecasting that apartment rents will only grow by about 0.3% – basically flat. Even the more optimistic predictions, like RealPage's 2.3% growth forecast, are still way below what we've seen in recent years.

This cooling is happening because of a massive wave of new apartment construction hitting the market. All those cranes you've been seeing around town? They're finally delivering results. The South and West are seeing the biggest inventory boosts, which means the most rent relief.

But here's where it gets tricky…

Why Lower Rents Might Be Fooling You

When you see headlines about dropping rents, your brain probably goes straight to "Great! Renting is cheaper now!" But you're only seeing half the picture. While rents are softening, some major changes are happening on the buying side that could completely flip the affordability equation.

Mortgage Rates Are Dropping Like a Rock

Remember when mortgage rates were flirting with 8%? Those days are behind us. Experts are predicting rates will drop to around 6% in 2026 – that's a full percentage point lower than where we started 2025.

That might not sound like a huge deal, but trust me, it is. A 1% drop in mortgage rates can save you hundreds of dollars per month on your payment. We're talking about potentially 5.5 million more people becoming qualified buyers, including about 1.6 million current renters who could suddenly afford to buy.

Home Prices Aren't Going Crazy Anymore

While rents are flatlining, home values are still growing – but at a much more reasonable pace. We're looking at about 1.2% to 2.2% annual growth in home values for 2026. That's nothing like the double-digit madness of 2021-2022.

Even better? When you adjust for inflation, home prices are actually expected to decline for the second year in a row. That means houses are becoming more affordable in real terms, even if the sticker price goes up slightly.

More Houses to Choose From

Remember when you had to make an offer sight-unseen and waive every contingency just to compete? Those days are fading fast. Housing inventory is expected to increase by 8.9% in 2026, giving you way more options and negotiating power than buyers have had in years.

The Hidden Costs of the "Cheaper Rent" Trap

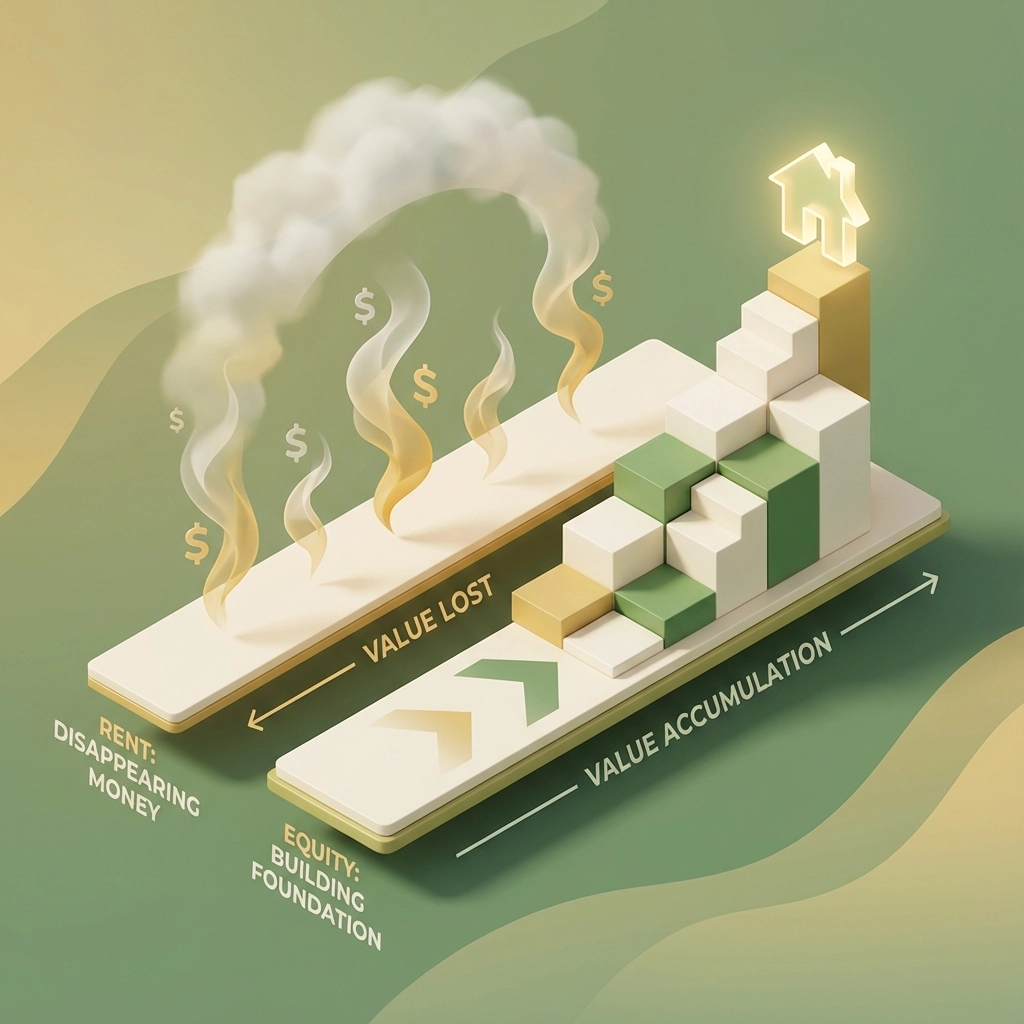

Here's what gets lost when you're celebrating lower rent payments: every rent payment is money you'll never see again. Meanwhile, even modest home price appreciation means you're building equity with every mortgage payment.

Let's say you're choosing between:

- Renting for $2,000/month (with that sweet 1% decrease)

- Buying with a $2,400/month mortgage payment (thanks to lower interest rates)

That extra $400 might seem like a no-brainer for renting. But here's what you're missing:

The Renting Reality:

- $2,000 x 12 months = $24,000 per year with zero return

- After 5 years: $120,000 spent, $0 equity built

- Your landlord gets all the benefits of any property value increases

The Buying Reality:

- $2,400 x 12 months = $28,800 per year, but you're building equity

- After 5 years: You own a chunk of a house that's likely worth more than when you bought it

- You get tax benefits, stable payments, and the freedom to renovate

The Real Kicker: Inflation Protection

Here's something most people don't think about – your mortgage payment stays the same, but your rent doesn't. Even with "soft" rent growth of 2-3% annually, you're still looking at increases. Meanwhile, your fixed mortgage payment becomes easier to afford as your income (hopefully) grows with inflation.

When Renting Still Makes Perfect Sense

Before you start house-hunting tomorrow, let's be real about when renting is still the smart play:

You Should Keep Renting If:

- You're planning to move within the next 3-5 years

- You don't have a solid emergency fund beyond your down payment

- Your job situation is unstable

- You're in a super expensive market where buying still costs way more than renting

- You value flexibility over building equity right now

- You hate dealing with maintenance and repairs

Renting works especially well in 2026 if:

- You're in a high-cost city where the buy vs. rent math still heavily favors renting

- You're in your early career and expect major life changes

- You're actively saving for a bigger down payment and better buying opportunity

How to Make the Right Decision for YOUR Situation

Don't let rent headlines make this decision for you. Here's how to figure out what actually makes sense:

Run the Real Numbers

Use online rent vs. buy calculators, but don't stop there. Factor in:

- Current mortgage rates in your area

- Property taxes and HOA fees

- Maintenance costs (budget 1-2% of home value annually)

- How long you plan to stay

- Your current rent trajectory vs. potential mortgage payments

Consider Your Life Timeline

Pro Tip: If you're planning to stay in the same area for 5+ years and have stable income, buying probably makes more sense than ever in 2026, despite "cheaper" rent options.

Look Beyond Monthly Payments

Ask yourself:

- How much equity could I build in 5 years of homeownership?

- What would my rent likely be in 5 years with continued increases?

- How important is stability and control over my living situation?

- Am I ready for the responsibilities of homeownership?

Get Local Market Insights

National trends are helpful, but your local market might be completely different. Some areas will see major rent drops while others stay expensive. Same goes for home prices and inventory.

The Bottom Line: Don't Let "Cheaper" Rent Fool You

Yes, rents are getting more affordable in many areas. But mortgage rates dropping, home price growth moderating, and inventory increasing means the buying landscape is improving even faster than the rental landscape.

The danger is focusing only on short-term monthly costs instead of long-term financial impact. That "expensive" mortgage payment might actually be building wealth while that "cheap" rent payment is just helping your landlord build theirs.

The key questions to ask yourself:

- Can I afford to buy responsibly with current rates and inventory?

- Do I plan to stay in this area long enough to make buying worthwhile?

- Am I prepared for homeownership responsibilities?

- What's the 5-10 year financial impact of each choice?

Ready to Explore Your Options?

The 2026 housing market is creating opportunities we haven't seen in years, but every situation is different. Whether you're wondering if it's finally time to buy or trying to figure out the best rental strategy, having expert local insights makes all the difference.

At The Dennedy Home Group, we help people navigate exactly these kinds of decisions every day. We can run the numbers for your specific situation, show you what's available in your price range, and help you understand the real costs and benefits of both renting and buying in today's market.

Don't let shifting rent prices make this decision for you – get the full picture first. Contact us today for a no-pressure consultation about what makes the most sense for your situation. Whether that's buying your first home, upgrading to something bigger, or finding the perfect rental while you plan your next move, we're here to help you make the smartest decision for your future.